February 5th, 2025

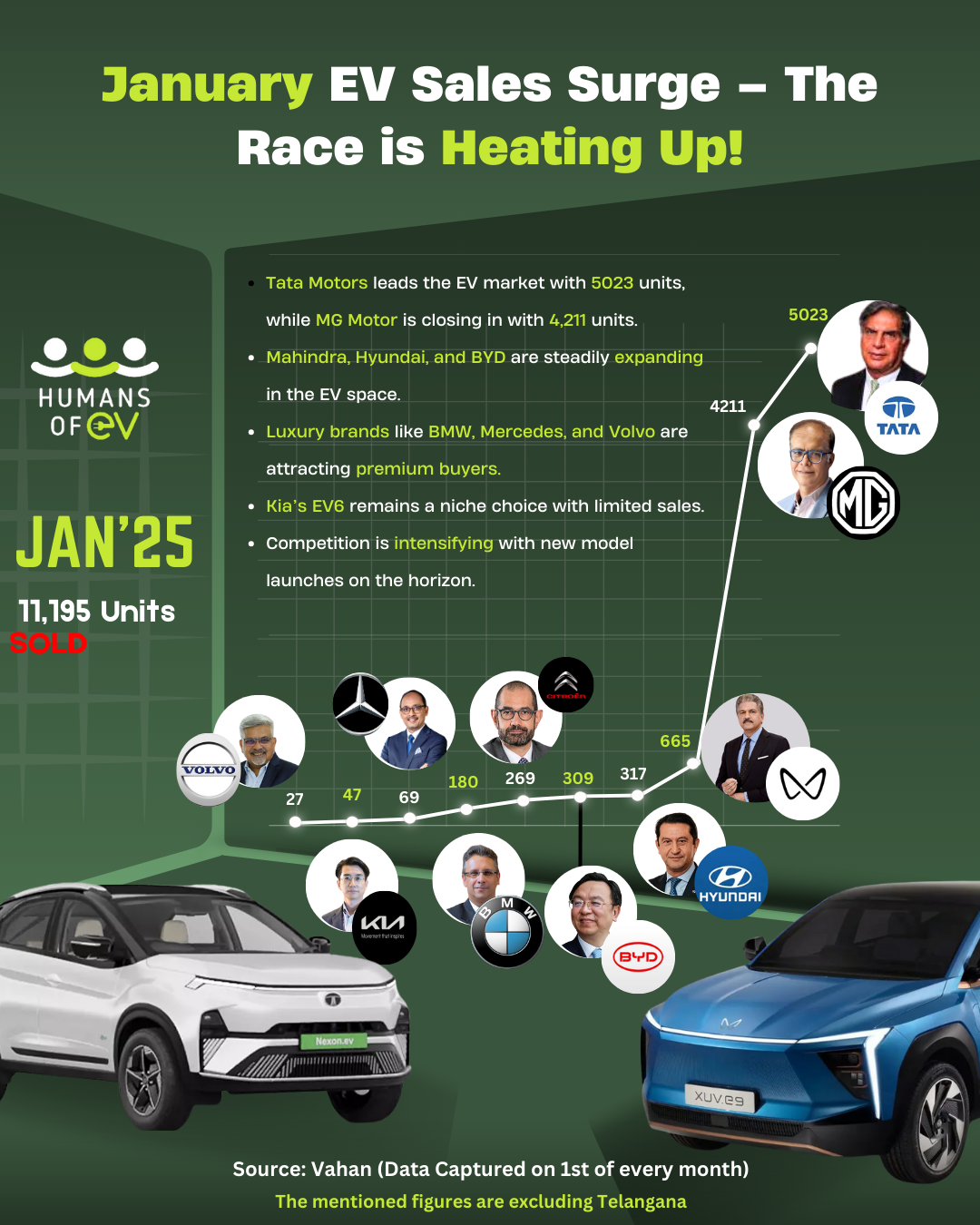

India’s electric vehicle market has kicked off 2025 with remarkable momentum, as January sales hit 11,195 units, signaling a transformative year ahead for green mobility. Amid growing environmental awareness and favorable government policies, the sector is witnessing unprecedented competition among automakers.

Market Leaders Race Ahead

Tata Motors continues to dominate India’s electric vehicle space, recording 5,023 deliveries in January. The company’s strategic pricing of the Nexon EV and Tiago EV, coupled with its extensive charging network, has helped maintain its market leadership. However, MG Motor is rapidly emerging as a formidable competitor, achieving 4,211 unit sales, primarily driven by strong demand for its ZS EV and the recently launched Comet EV.

New Players Reshape Competition

The competitive landscape is evolving as Mahindra & Mahindra reports 665 unit sales, primarily from its XUV400 model. The company’s upcoming Born Electric range promises to shake up the market dynamics further. Meanwhile, Hyundai and BYD are carving their niches, delivering 317 and 309 units respectively, with models like the Ioniq 5 and Atto 3 gaining traction among premium buyers.

Premium Segment Shows Promise

Luxury electric vehicles are finding their footing in the Indian market, with BMW leading the premium segment with 180 units sold. The success of its iX and i4 models demonstrates growing appetite for high-end EVs. Mercedes-Benz follows with 69 units, while Volvo’s XC40 Recharge and C40 Recharge contributed to 27 deliveries. Kia’s EV6, with 47 units sold, maintains its exclusive market positioning.

Market Insights Point to Shifting Dynamics

The January sales data reveals several key trends shaping India’s EV landscape. Tata Motors’ near 50% market share underscores the importance of affordable pricing and robust infrastructure. MG Motor’s significant gains suggest growing consumer confidence in newer brands, while Mahindra’s strategic moves hint at potential market disruption.

The luxury segment’s steady growth indicates maturing consumer preferences, with premium buyers increasingly embracing electric mobility. As manufacturers prepare to launch new models throughout 2025, the market is poised for increased competition and innovation.

Looking ahead, 2025 promises further evolution in India’s EV market. With established players strengthening their positions and new entrants bringing fresh offerings, consumers can expect more choices and enhanced features in the electric vehicle space. The question remains whether Tata Motors can maintain its leadership as competitors intensify their market presence.