Just a year ago, JBM Auto held barely 1% of India’s electric bus market. By July 2025, its share had surged past 40%. What changed? Capital, contracts, and consumer demand formed a flywheel that could reshape India’s EV mobility story. In an industry dominated by legacy automakers and held back by supply chain complexity, can funding, policy, and market demand create a self-reinforcing loop for JBM — and is this India’s model for e-mobility growth?

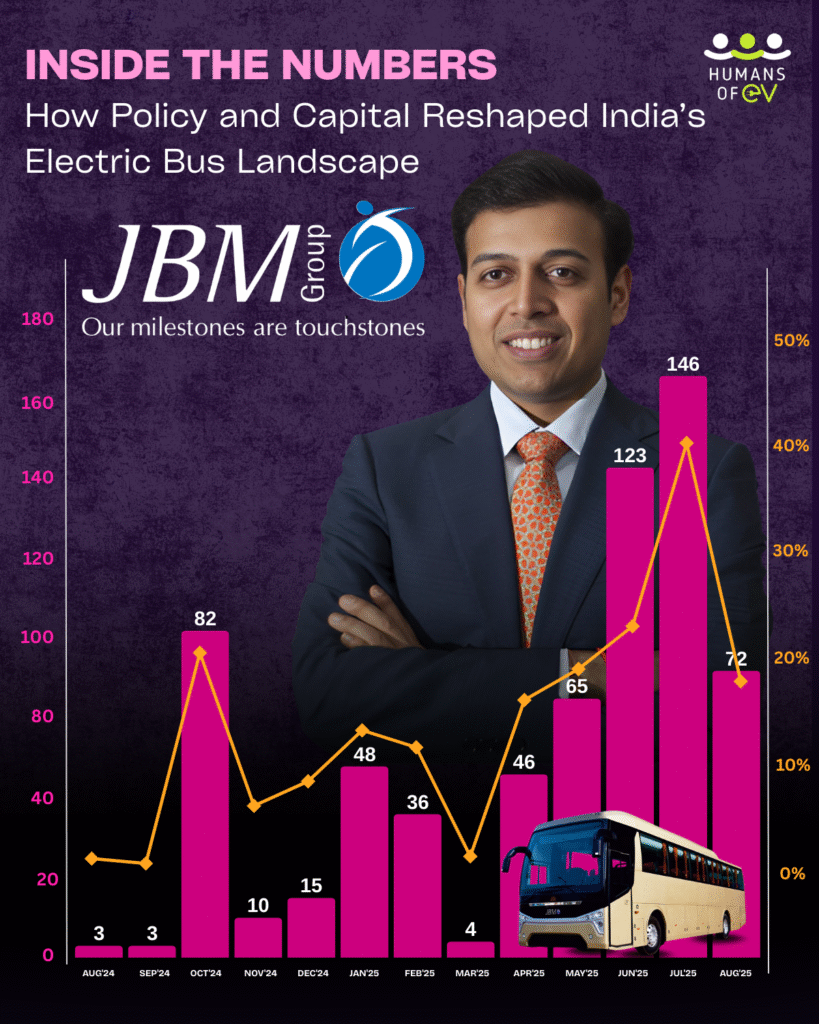

The Numbers Don’t Lie: 12 Months of Sales Data

From September 2024 to August 2025, JBM Auto’s trajectory has been anything but linear. The company sold just three e-buses in both August and September 2024, but by October, that number leapt to 82 units. Growth spiked again in June and July 2025, hitting 123 and 146 buses respectively, with the firm peaking at 40.4% market share in July. While August sales dipped to 72, the overarching trend is clear: JBM went from a marginal participant to a dominant force. Each sales spike corresponds to major contract wins or policy changes, underlining that the path to leadership was defined by volatility and opportunity—rather than gradual, predictable scaling.

Capital Injection: IFC’s $100M+ Bet

The turning point came with the $100 million investment from the International Finance Corporation (IFC) into JBM Ecolife, the company’s electric bus arm—the largest e-mobility project IFC has ever undertaken globally. This was soon followed by an additional $137 million IFC backing into the JBM–GreenCell joint venture. These infusions gave JBM the liquidity needed to scale manufacturing capacity, expand its fleet, and fund urban infrastructure readiness—fueling a rapid expansion across Maharashtra, Assam, Gujarat, and beyond. As IFC’s Makhtar Diop remarked, “E-mobility is the future — and we are making it real through investments in leaders like JBM. India’s leadership is accelerating its own transition while shaping how cities worldwide finance the next generation of mobility.”

But this is not simply venture capital chasing a trend—IFC’s engagement signals confidence in JBM’s ability to execute, deliver, and perhaps lead India’s charge into a global EV export market. The capital enabled operational scale and sent a market-wide signal on confidence and solvency.

Policy Tailwinds: GST 2.0 and State-Level E-Bus Push

JBM’s rise coincided with favorable government policies. Recent revisions in GST and targeted state-level subsidies offered cost relief for operators, making e-buses more attractive for city fleets. PM e-Bus Sewa and PM E-DRIVE programmes provided guaranteed contracts, accelerating municipal and state-level adoption. For JBM, this meant stable demand—order book reached ₹12,900 crore as of August 2025, including 2,411 buses under PM e-Bus Sewa. Policy as leverage was crucial. Simply put, JBM’s sharp ascent would have been impossible without government-backed demand guarantees and tender-driven contracts.

The Flywheel Effect: Investment, Policy, Demand

Here’s the mechanism:

- Investment provides the capital needed for scaling production.

- Policy secures demand via tenders and subsidies.

- Demand demonstrates commercial viability, attracting further investment.

The sequence creates a loop where each driver reinforces the other. As IFC’s funds landed, market confidence spiked—mirrored in JBM’s rising sales and market share. If this flywheel spins faster, JBM could well set the benchmark for India’s entire EV ecosystem.

Challenges Along the Way

Yet growth brought challenges. Sales volatility mirrors a dependency on contract timing; the lack of steady month-over-month sales highlights risks if tenders slow or policies shift. Supply chain delays, formidable competition from Olectra and Tata Motors, and infrastructure bottlenecks remain. Funding alone doesn’t guarantee sustainable profitability, and JBM must manage scale smartly.

Future Outlook: Can JBM Scale Beyond India?

Export ambitions are on the horizon. IFC’s investment is already helping JBM deploy buses in Europe, the Middle East, and APAC. With India targeting 40% EV penetration by 2030, JBM’s flywheel model for capital, policy, and demand may become the blueprint for emerging-market EV manufacturing. The big question: Will JBM stay ahead as rivals scale, or is its story still fragile?