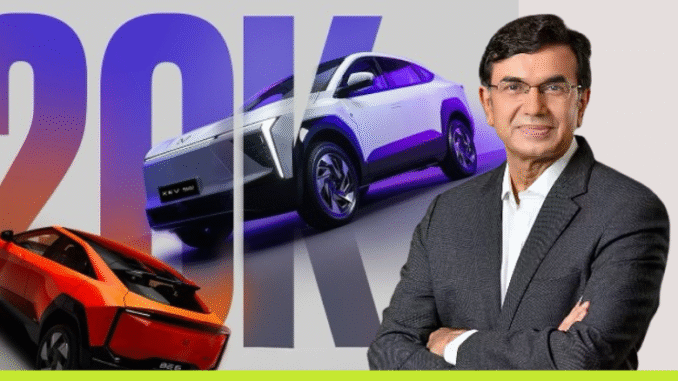

Five months ago, the first batch of Mahindra’s BE 6e and XEV 9e rolled out to Indian customers. Today, 20,000 vehicles are already on the road, collectively clocking 93 crore kilometres.

But what does this number really tell us — is India finally stepping into an EV mainstream? This is not just a story of cars sold, but of policy shifts, consumer confidence, and a turning point in how Indians think about mobility.

The Growth Curve That Turned Heads

When Mahindra began deliveries in April, industry watchers anticipated a steady ramp-up. Instead, the adoption curve looked more like a sprint. The company delivered 3,000 units in March, crossed 10,000 by June, and by early September touched the 20,000 mark.

To put it in perspective, that’s nearly one EV every six minutes since launch. In a market where electric adoption has often been incremental, the rapid uptake of Mahindra’s dual-flagship models turned heads.

The growth is not just numerical; it signals momentum. A journey that once seemed confined to “early adopters” has begun to pull in mainstream families, professionals, and fleet buyers.

Policy Meets the Driveway: GST 2.0’s Impact

Behind the surge lies a crucial factor: GST 2.0. Effective from September 6, 2025, the revised tax regime significantly lowered levies on electric vehicles. Mahindra responded by passing the full benefit directly to customers, a move that reset affordability benchmarks almost overnight.

The impact was tangible. The BE 6e’s price gap with a comparable diesel SUV narrowed sharply, making it a real alternative for families debating between conventional and electric. As one Mahindra executive noted, “For the first time, customers weren’t asking if they should go electric, but why not?”

Competitors Tata and Hyundai, while already active in EVs, now face a market where value perception has shifted. For buyers, the calculus of running costs, resale, and upfront affordability suddenly tilted in favour of EVs.

93 Crore Kilometres and What They Mean

Numbers only matter if they tell a story. And 93 crore kilometres in five months does. It translates to over 10 lakh Delhi–Kanyakumari trips.

The implication is clear: owners are not treating their EVs as “secondary city cars.” These are primary vehicles for commutes, road trips, and daily life. If range anxiety were a dealbreaker, such extensive real-world usage would not have been possible.

Moreover, the environmental dividends are significant. Based on industry averages, this distance potentially offsets over 90,000 tonnes of CO₂ emissions and saves nearly 35 million litres of petrol.

Beyond the Enthusiasts: Everyday India Joins the EV Club

The early EV market was dominated by enthusiasts willing to experiment with new technology. The BE 6e and XEV 9e wave tells a different story. Family buyers, young professionals, and even corporate fleets are now joining the fold.

Resale confidence, improved charging infrastructure, and the pride of driving clean are reshaping the emotional side of the purchase. EVs are no longer status experiments; they are first-choice family cars.

A Bengaluru-based owner put it simply during a customer event: “Earlier, my EV was the car for weekends. Now, it’s the car for everything.”

The Roadblocks Ahead

Of course, the journey is not without obstacles. Charging infrastructure is uneven, grid readiness remains a concern, and after-sales service capacity must keep pace with sales.

The risk is structural: exponential adoption colliding with infrastructure that is still catching up. It raises a pivotal question for policymakers and automakers alike — what happens when demand outstrips ecosystem readiness?

India’s EV Inflection Point?

The shift is unmistakable. The driveway is no longer just for diesel and petrol.

Taken together — 20,000 sales, GST 2.0’s affordability push, 93 crore kilometres of usage, and shifting consumer behaviour — the narrative points toward more than just Mahindra’s success.