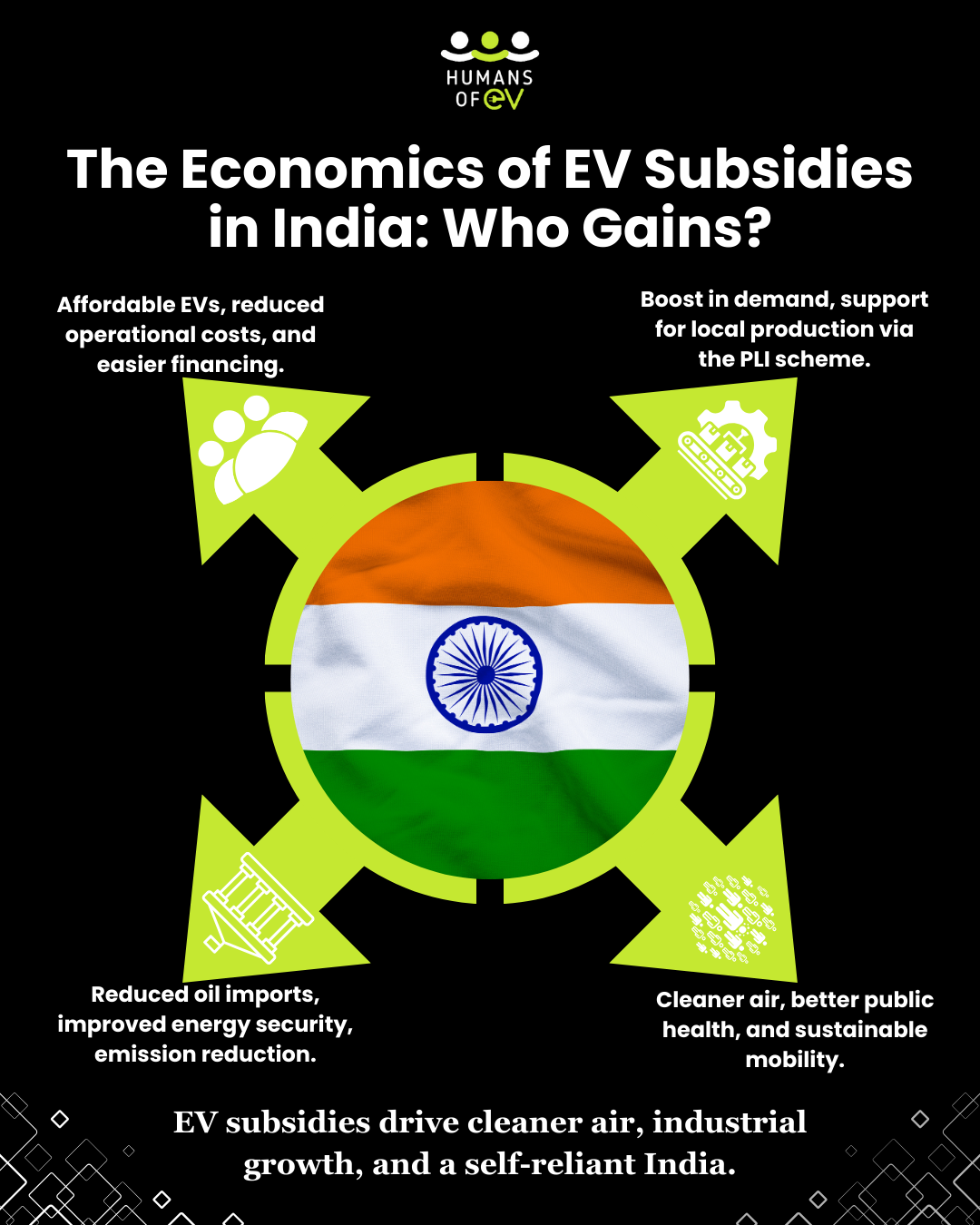

The economics of electric vehicle (EV) subsidies in India is shaped by the country’s goals of reducing greenhouse gas emissions, lowering oil imports, and promoting sustainable mobility. Here’s a breakdown of who benefits, how and why:

Consumers

- Lower Cost of Ownership: EV subsidies reduce the upfront cost of EVs, making them more accessible to middle-income and price-sensitive consumers.

- Operational Savings: EVs are cheaper to operate due to lower fuel and maintenance costs. The subsidies amplify these savings, increasing the economic appeal of EV

ownership. - Access to Financing: Subsidies improve affordability, enabling more people to qualify for loans or financing schemes.

Manufacturers

- Market Growth: Subsidies encourage more buyers, creating a larger market for EV manufacturers.

- Local Production Incentives: Many subsidies are tied to domestic manufacturing (e.g., India’s Production-Linked Incentive (PLI) scheme, boosting local production and creating economies of scale.

Government

- Energy Security: By reducing dependence on imported oil, subsidies contribute to lower trade deficits and improved energy independence.

- Environmental Goals: Incentivizing EV adoption helps meet commitments to reduce carbon emissions and improve urban air quality.

- Job Creation: Subsidies encourage the growth of related industries (e.g., battery production, charging infrastructure), leading to job creation in manufacturing and services.

Charging Infrastructure Developers

EV subsidies often include provisions for funding charging stations, fostering rapid expansion in this sector. Public-private partnerships for charging networks attract investments and innovation.

Society

- Improved Air Quality: Subsidies promoting EVs contribute to reduced air pollution, particularly in urban areas.

- Economic Diversification: Supporting EVs drives the transition to a greener economy, fostering new industries and reducing reliance on traditional automotive manufacturing.

Economic Implications

- Short-Term Costs for Governments: Subsidies are a fiscal burden in the short term, funded by taxpayer money or reallocation of existing budgets.To be sustainable, the government must ensure revenue-neutral mechanisms, such as imposing taxes on polluting vehicles or fuels.

- Economic Stimulus: By fostering a new industry, EV subsidies stimulate economic activity, particularly in manufacturing and services.

- Import Dependency: While reducing crude oil imports, India currently relies on imported EV batteries and components. Localizing battery production is critical to maximize economic benefits.

- Long-Term Payoff: Subsidies accelerate EV adoption, leading to long-term savings in health costs due to cleaner air, reduced fuel import bills, and economic gains from green industry leadership.

Challenges

- Wealth Distribution: Subsidies can sometimes disproportionately benefit affluent consumers who are early adopters of expensive EVs.

- Policy Implementation: Ensuring that subsidies reach targeted beneficiaries, such as small vehicle owners, rural users, or businesses, is essential.

- Infrastructure Readiness: Subsidies alone won’t suffice without adequate investment in charging networks and grid stability.

Key Policies in India

- FAME II (Faster Adoption and Manufacturing of Hybrid and Electric Vehicles): Provides subsidies for electric two-wheelers, three-wheelers, buses, and private EVs.

- PLI Scheme for Advanced Chemistry Cell Batteries: Encourages domestic production of batteries.

- State-Level Incentives: States like Delhi, Maharashtra, and Tamil Nadu offer additional incentives, tax exemptions, and registration fee waivers.

Conclusion

The economic benefits of EV subsidies in India are multi-fold, driving consumer adoption, industrial growth, and environmental progress. However, for sustained impact, policies must evolve to support infrastructure, localize supply chains, and ensure equitable access