Electric two-wheelers anchor EV adoption in India, propelled by affordability and daily-use economics. Passenger cars gear up as the fastest-growing segment from 2026, boosted by expanding charging networks and diverse options. Capgemini highlights total cost benefits, charging access, and digitisation as key growth engines across urban tiers.

Two-Wheelers Lead Penetration

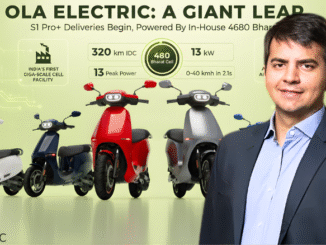

Two- and three-wheelers, plus last-mile commercial vehicles, achieve deepest EV penetration in India. These segments suit electrification through strong economics, minimal charging demands, and urban mobility alignment. Anuraag Bharadwaj, Capgemini’s Automotive Industry Platform Leader for India, notes global passenger car dominance yields to India’s two-wheeler focus.

Tech Shifts OEM Models

Digital clusters in two-wheelers mimic car infotainment with navigation, diagnostics, and content. Software-defined vehicles push OEMs beyond sales toward subscriptions and feature monetisation. Bharadwaj emphasises value-conscious consumers drive this connected services pivot.

Battery Hurdles Stall Profits

Batteries claim 40% of EV costs, with localisation lagging in cell manufacturing despite assembly progress. Imports from China persist, capping profitability; firms like Mahindra source Blade cells from BYD for models like Maruti eVitara. Production Linked Incentive schemes spur gigafactories, but scale and supply resilience define future leaders, per Capgemini.