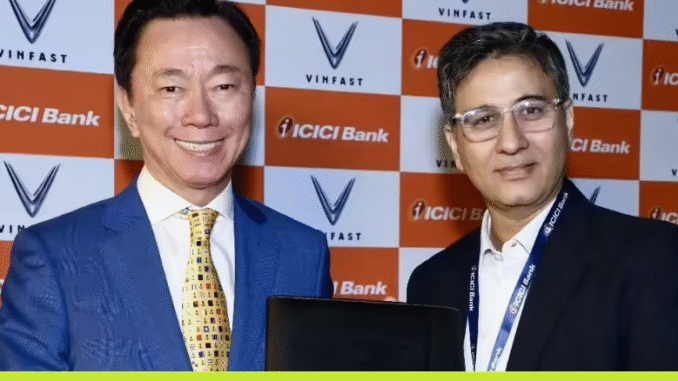

VinFast Auto India, the Indian arm of global EV manufacturer VinFast, has entered into a strategic partnership with ICICI Bank to make electric vehicle ownership easier and more affordable. The collaboration aims to enhance financing options and drive greater adoption of EVs in India, one of the world’s fastest-growing automobile markets.

Expanding Access to EV Financing

Through this partnership, customers purchasing VinFast electric vehicles in India will gain access to a wide range of tailored financing solutions. These will include:

- Attractive loan offerings with flexible tenure options

- Competitive interest rates designed to lower ownership costs

- Seamless digital application processes for quick approvals

By easing the financial burden, the initiative intends to support both individual buyers and business fleets, thereby boosting EV penetration beyond metro cities.

Driving India’s EV Adoption Goals

Speaking on the collaboration, Munish Gaur, Product Head – Vehicles, ICICI Bank, said:

“As EV adoption accelerates in India, our partnership with VinFast will provide customers with easy and flexible financing options, ensuring a smoother transition to electric mobility.”

VinFast Auto India also emphasized that the move is aligned with its commitment to building a robust ecosystem that complements India’s green mobility ambitions.

A Step Toward a Sustainable Future

India is targeting 30% electrification of vehicles by 2030, and financing remains a key hurdle. By partnering with one of India’s leading private sector banks, VinFast is positioning itself to bridge the affordability gap and make EVs accessible to a wider audience.

This collaboration is expected to create a win-win situation for both customers and the broader EV ecosystem, combining VinFast’s innovative vehicles with ICICI Bank’s financial expertise.