The Rise of Electric Cabs in India: A Game-Changer for Mobility

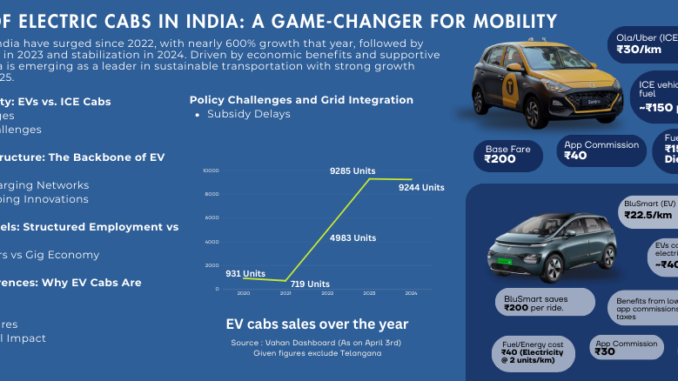

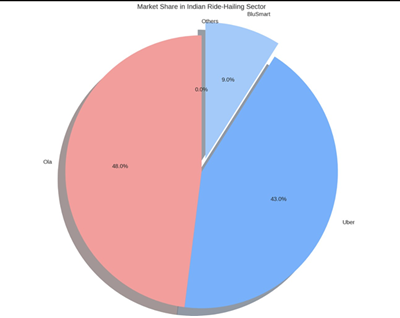

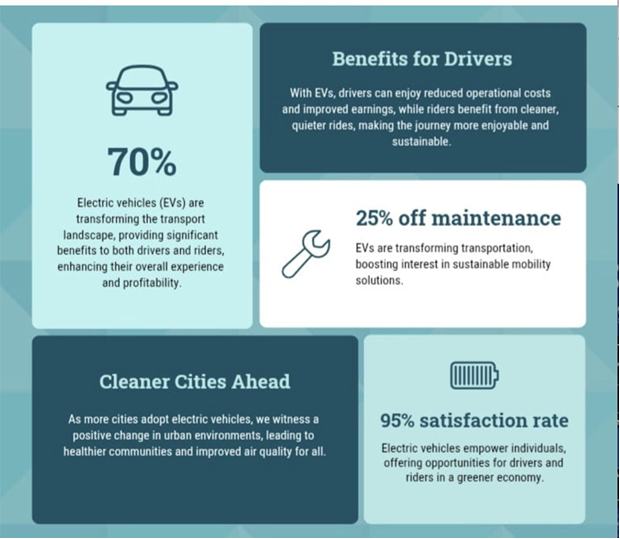

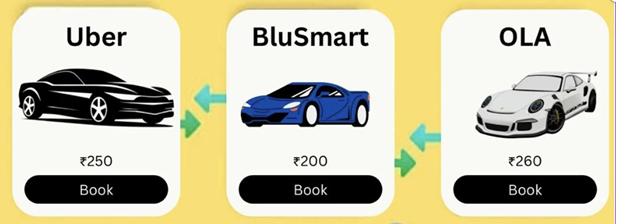

India’s $13.4 billion ride-hailing market is undergoing a transformation as electric vehicles (EVs) challenge the dominance of internal combustion engine (ICE) cabs. With growing consumer demand for sustainable transport, government incentives, and operational cost advantages, EV adoption is accelerating. This report highlights the economic, operational, and consumer dynamics driving EV cabs, referencing key players like BluSmart and Shoffr while focusing on the broader industry trends.

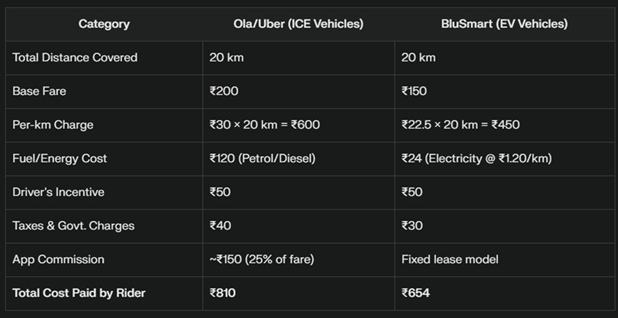

1. Economic Viability: EVs vs. ICE Cabs

Cost Advantages

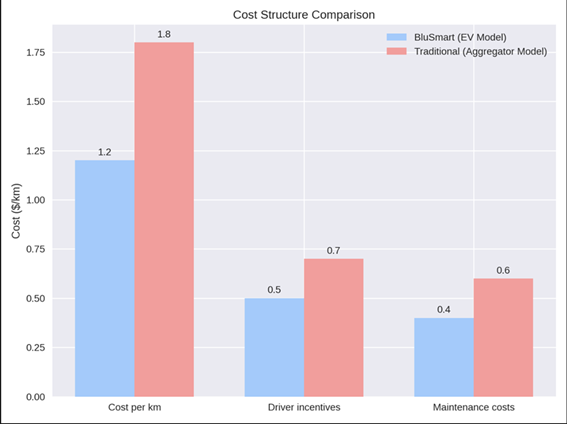

EVs offer significant operational cost benefits over ICE vehicles. For example, EVs like the Tata Nexon incur energy costs of ₹0.82/km, compared to ₹6.50/km for diesel and ₹5.20/km for CNG vehicles. Maintenance costs are also 40–50% lower due to fewer moving parts, making EVs more economical for high-utilization fleets.

While upfront costs remain higher—₹17.49–21.99 lakh for EVs compared to ₹5.8–7.6 lakh for ICE vehicles—government subsidies under FAME-II and state policies help bridge this gap by up to 22%. These incentives make EVs increasingly viable for commercial operators focused on long-term savings.

Financing Challenges

Despite operational advantages, financing remains a challenge. EV loans often carry higher interest rates than ICE vehicle loans, and residual value uncertainty discourages individual ownership. EVs depreciate faster (60–65% over five years) compared to ICE vehicles (45–50%). Fleet operators mitigate these risks by retaining ownership of vehicles and leasing them to drivers.

2. Charging Infrastructure: The Backbone of EV Fleets

Dedicated Charging Networks

A reliable charging network is essential for efficient EV fleet operations. Companies like BluSmart have developed dedicated charging hubs across cities like Delhi-NCR and Bengaluru, ensuring seamless access for their fleets. Each hub costs ₹1.2–1.8 crore to build and prioritizes overnight slow charging at lower tariffs (₹4.5/kWh), reducing operational costs compared to daytime rates of ₹8/kWh.

Battery Swapping Innovations

Battery swapping pilots are emerging as a solution to reduce downtime for EV fleets. This approach enables swaps in under five minutes compared to traditional charging methods that take up to 90 minutes, significantly improving fleet efficiency.

3. Operational Models: Structured Employment vs Gig Work

Salaried Drivers vs Gig Economy

Structured employment models are gaining traction in the EV cab space as they address driver attrition and efficiency issues prevalent in gig-based systems used by ICE platforms like Ola and Uber. For instance, BluSmart employs drivers on fixed salaries with performance bonuses, reducing attrition rates to 9% compared to 35–40% for gig workers.

Legacy platforms are adopting hybrid models to compete in the EV space, offering leased EVs with maintenance packages or reduced commission rates for drivers operating electric vehicles.

4. Consumer Preferences: Why EV Cabs Are Gaining Traction

EV cabs address key consumer concerns:

- Predictable Fares: Avoidance of surge pricing attracts 68% of users.

- Reliability: Platforms offering zero ride cancellations outperform traditional ICE services with cancellation rates as high as 27%.

- Environmental Impact: Improved air quality motivates 54% of users.

Premium services featuring high-end electric vehicles like the Mercedes EQB or Hyundai Kona are also gaining popularity among affluent consumers, contributing significantly to revenue growth in urban markets.

5. Policy Challenges and Grid Integration

Subsidy Delays

Government subsidies play a critical role in promoting EV adoption but face delays in disbursement—only a fraction of allocated funds under FAME-II have been utilized effectively, slowing fleet expansion efforts.

Grid Stability

The increasing demand from EV charging hubs poses challenges for grid stability in urban areas. A single hub with 100 chargers consumes up to 6 MW daily—equivalent to powering 3,000 households—prompting utilities to mandate renewable energy usage at charging stations.

Conclusion

EV cabs are reshaping India’s urban mobility landscape by offering cost advantages and addressing consumer concerns around reliability and sustainability. While startups like BluSmart and Shoffr lead innovation with vertically integrated models, legacy players like Ola and Uber must accelerate their transition strategies to remain competitive. Policymakers need to streamline subsidies and strengthen infrastructure to support this transformation. With battery prices projected to fall below $75/kWh by 2027, price parity between EVs and ICE vehicles will likely make electric mobility the dominant force in India’s ride-hailing ecosystem by 2030.

References

https://cleanmobilityshift.com/market-trends/how-blusmart-mobility-is-disrupting-in dias-ride-hailing-market/?utm_source=chatgpt.com

https://www.business-standard.com/india-news/blusmart-seeking-to-challenge-uber-ola-with-an-all-electric-taxi-fleet-123041900220_1.html?utm_source=chatgpt.com

https://www.reuters.com/world/india/uber-adopts-smaller-rivals-model-india-autoric kshaw-rides-weather-competition-2025-02-18/?utm_source=chatgpt.com

https://auto.economictimes.indiatimes.com/news/aftermarket/better-incentives-spik e-ola-driver-logins-by-10/73718433

https://www.newsdrum.in/business/uber-ola-will-have-to-fall-in-line-as-karnataka-go vt-fixes-uniform-fare-for-taxis-3587138