India’s streets, long dominated by petrol-powered two-wheelers, are now echoing with the quiet hum of electric motors. This shift isn’t just a trend but a transformation driven by policy, innovation, and the push for cleaner, more affordable mobility.

| YEAR | TOTAL 2W SALES | ELECTRIC 2W SALES | EV MARKET SHARE(%) |

| 2020 | 1,42,97,890 | 27,027 | 0.19 |

| 2021 | 1,39,16,487 | 1,53,891 | 1.11 |

| 2022 | 1,55,65,899 | 6,27,376 | 4.03 |

| 2023 | 1,70,56,512 | 8,58,320 | 5.03 |

| 2024 | 1,89,04,375 | 11,44,178 | 6.05 |

What does this mean?

In 2020, electric two-wheelers were barely a blip—just 0.19% of all sales.

By 2024, their market share rose to over 6%, with sales increasing more than forty-fold.

In March 2025, electric two-wheelers hit a record 8.7% of sales before dropping to 5.45% in April, showing the market’s sensitivity to policy changes.

The Engine Behind the EV Boom

- FAME-II (2019–2024):

- Key driver of electric two-wheeler adoption in India.

- Provided up to ₹22,500 subsidy per vehicle.

- Supported sale of over 700,000 electric two-wheelers.

- EMPS 2024:

- Replaced FAME-II in April 2024.

- Halved subsidy to ₹10,000, causing a brief sales dip (3.97% in April).

- Market rebounded, showing growing consumer confidence.

- PM E-DRIVE (Late 2024):

- ₹10,900 crore initiative to support 2.5 million commercial EVs.

- Aims to install 72,300 charging stations by 2026.

- Focuses on building a strong EV ecosystem.

Why Are Indians Switching? The Value Proposition

Total Cost of Ownership

Electric two-wheelers are now 70% cheaper to run than petrol models. With electricity rates far below petrol prices and fewer moving parts to maintain, riders save ₹3,000–₹5,000 per month on fuel and servicing.

Environmental and Social Factors

- Zero tailpipe emissions mean cleaner air,

- Quieter rides reduce noise pollution.

- Peer and social influence: Seeing others go electric is speeding up adoption.

Technology and Features

Advances in battery tech have improved range and charging time. Premium models offer smart features like app integration and remote diagnostics. With 3,000+ battery swapping stations, refueling is now as quick as a petrol top-up.p.

The S-Curve: Understanding the Growth Trajectory

- Early Adoption (2020–2022): Eco-conscious urban buyers.

- Rapid Growth (2023–2025): Mainstream buyers in Tier 2/3 cities and commercial fleets.

- Mass Adoption (Post-2025):EVs become the default choice.India hit the 5% EV tipping point in 2023; UP and Karnataka now top 8% EV.

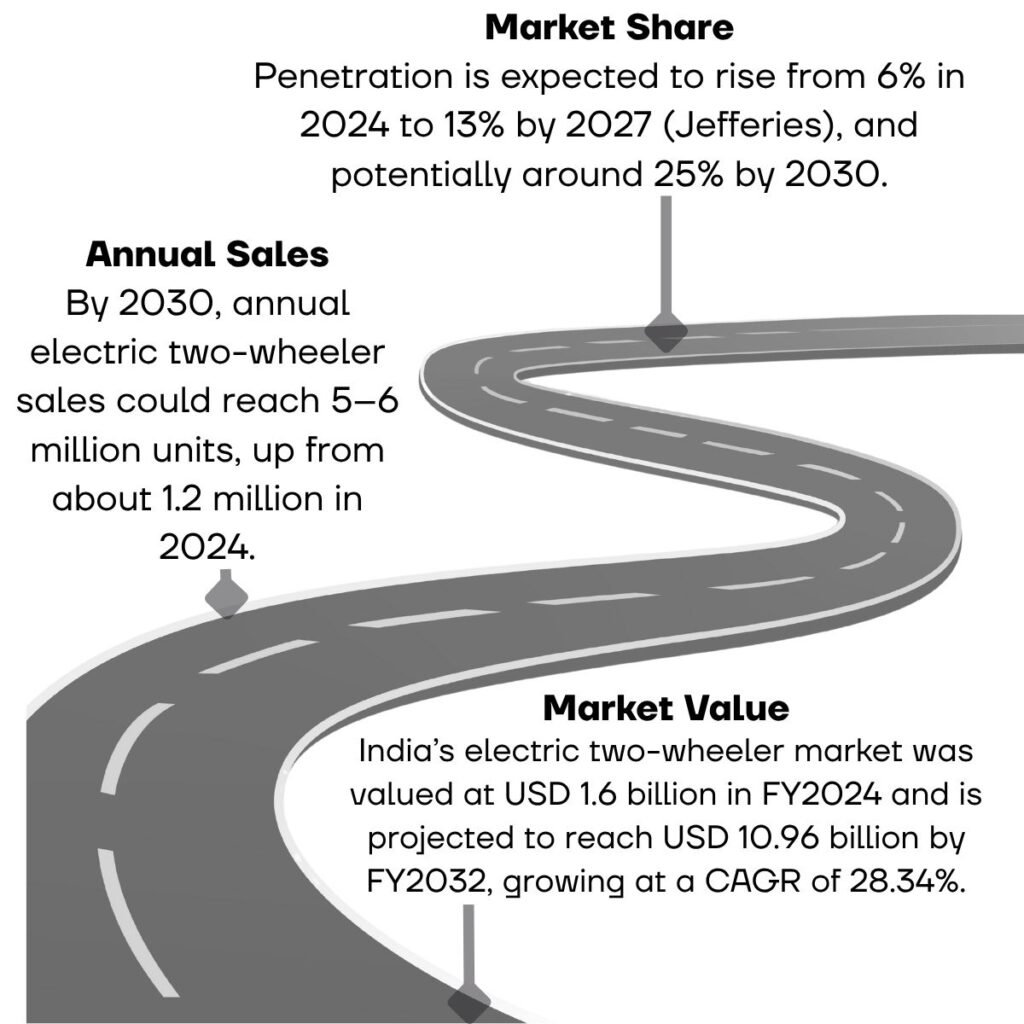

The Road Ahead: 2025–2030 and Beyond