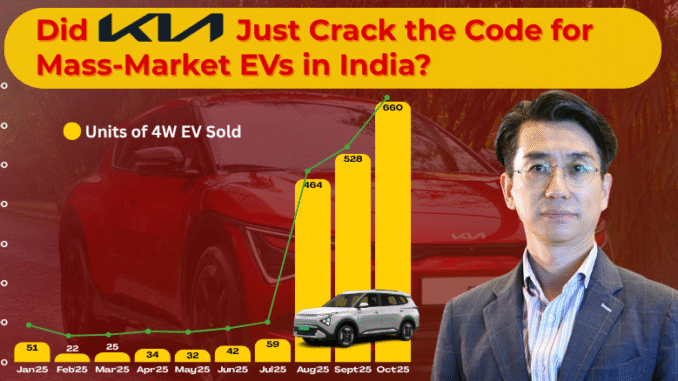

Kia India’s 2025 electric vehicle sales chart tells a story of strategic genius, not gradual growth. For seven months, the company’s EV sales were a virtual flatline, averaging just 40 units per month. Then, in August, the market was struck by lightning: sales exploded by a staggering 686% to 464 units, climbing further to a record 660 units by October. This was not a seasonal fluke or a random spike in demand; it was the calculated outcome of a meticulously planned, two-phase strategy that pivoted from exclusive, brand-building imports to an accessible, locally manufactured mass-market vehicle, all supported by a pre-built ecosystem.

Phase 1: Building the “Halo” (January–July 2025)

The nominal sales figures from January to July reflect Kia’s initial EV portfolio, which consisted exclusively of high-priced, Completely Built Unit (CBU) imports. These vehicles were never intended for mass sales. The sporty EV6 crossover (approx. ₹65.97 lakh) and the luxury three-row EV9 SUV (approx. ₹1.30 crore) served as high-tech ambassadors. Their role was strategic: to establish the Kia brand as a credible, high-tech player in the EV space and build a reservoir of brand equity and technological credibility. By showcasing cutting-edge design and performance, Kia created customer aspiration while its Indian operations prepared for the real offensive.

Phase 2: The “Volume” Pivot (August–October 2025)

The entire sales trajectory was fundamentally altered by a single event: the launch of the Kia Carens Clavis EV on July 15, 2025. This was the fulcrum of the entire strategy, shifting the company’s focus from brand-building to market capture. The following table illustrates this dramatic shift:

| Strategy Aspect | Phase 1: Halo (EV6 & EV9) | Phase 2: Volume (Carens Clavis EV) |

| Manufacturing | Imported as CBU | Locally Manufactured (Anantapur) |

| Target Segment | Luxury / Aspirational | Mass-Premium Family |

| Starting Price | ₹65.97 Lakh – ₹1.30 Crore | ₹17.99 Lakh |

| Tax Structure | High Import Duties + GST | Low 5% EV GST Rate |

| Sales Impact | Low Volume (Avg. 40/month) | High Volume (660 units in Oct) |

The explosive growth in the second half of the year was the direct result of activating a multi-pillar strategy.

Product & Positioning: The Carens Clavis EV was strategically designed as India’s first 7-seater, mass-premium electric MPV, targeting the large and underserved family segment. While competitors focused on compact SUVs, Kia identified and filled a significant market gap. Premium features like a panoramic sunroof, dual 12.3-inch screens, and Level 2 ADAS attracted tech-savvy buyers, while offering two battery options (a 42kWh Standard Range and a 51.4kWh Extended Range) provided choice in performance and affordability.

Manufacturing & Pricing: The vehicle’s success was enabled by localization. It is manufactured at Kia’s Anantapur plant as part of a ₹2,000 crore EV investment. This allowed Kia to leverage the 5% EV GST rate, avoid heavy CBU duties, and launch the vehicle at an aggressive ₹17.99 lakh (ex-showroom). This price point shattered the barrier between Kia’s premium brand image and mass-market accessibility, instantly democratizing its EV offerings.

Ecosystem & Service: Understanding that anxiety over charging and service are the biggest barriers to adoption, Kia built the support ecosystem before the launch. Its “K-Charge” initiative provided owners access to over 11,000 charging points across 18 partner operators via the “MyKia” app, complete with a route planner. Simultaneously, Kia ensured day-one service readiness with over 250 EV-ready workshops and 100+ dealerships equipped with DC fast chargers. An 8-year/1,60,000 km battery warranty further de-risked the purchase for first-time EV buyers.

Conclusion

Kia’s 2025 EV performance is a masterclass in market creation. The initial “halo” phase used low-volume, high-cost imports to build a powerful brand reputation. The “volume” phase then monetized that reputation by launching a locally produced, high-appeal, and aggressively priced product into a ready-made ecosystem. The dramatic sales surge from July to August was not a fluke; it was the turning of a key, unlocking latent demand that Kia itself had cultivated. This textbook case study proves that in a price-sensitive and infrastructure-anxious market, success is not just about the product—it’s about a perfectly synchronized strategy.