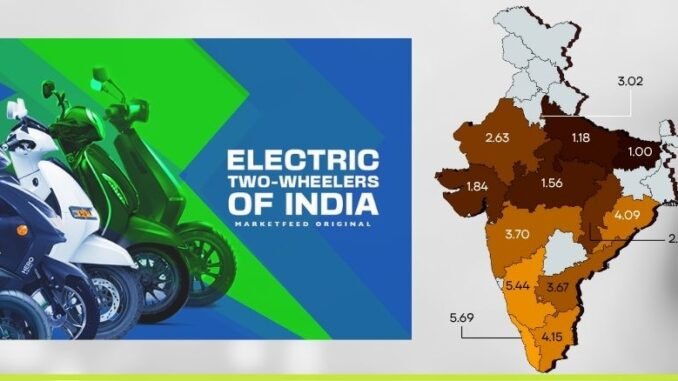

India’s electric two-wheeler market is accelerating rapidly, reshaping how millions commute daily. Yet, this growth is uneven across regions, prompting a key question: are incentives truly driving where and how fast people adopt electric two-wheelers?

Affordability remains a critical factor for many buyers, and incentives have the potential to lower entry barriers significantly. Beyond cost, factors like charging accessibility, consumer awareness, and local support ecosystems also influence adoption. Early evidence shows that where incentives align well with these factors, adoption rates soar, while areas lacking targeted support see slower growth despite rising interest.

As the electric two-wheeler revolution unfolds, understanding the real impact of incentives on consumer choices and regional adoption patterns is essential. This article explores how these financial motivations are shaping India’s electric mobility landscape, revealing insights into what truly moves the needle for riders across the country.

India’s electric vehicle (EV) adoption has surged in 2025, driven by targeted state policies, infrastructure expansion, and shifting consumer preferences. While metro cities initially led the charge, smaller cities and states with localized strategies are now accelerating the transition. Here’s a cohesive breakdown of how incentives and policies are reshaping the landscape, backed by the latest data and trends.

Maharashtra remains India’s EV capital, with 2.12 lakh electric two-wheelers (E2Ws) sold in FY2025, capturing 18.5% of national sales. Its success stems from aggressive subsidies:

- 100% road tax exemption and toll-free travel on key expressways like Mumbai-Pune

- Charging infrastructure mandates on stations every 25 km on highways.

Karnataka, despite no direct buyer subsidies, leads in charging networks (5,765 stations). Bengaluru’s tech-savvy population and gig economy drivers (Swiggy, Zomato) propelled 1.43 lakh E2W sales, proving infrastructure matters as much as cash incentives.

Tamil Nadu targets gig workers with ₹20,000 subsidies and exempts road tax for E2Ws. Chennai and Coimbatore now account for 32% of India’s EV exports, fueled by Hyundai and Ather Energy’s local plants.

Tier 2 and 3 Cities: The New Growth Engines

- Smaller cities are closing the gap with metros:

- EV penetration in tier 2 cities hit 10.67% in FY2025, up from 4.16% in 2022.

- Surat sold 65,845 EVs in 2025, driven by affordable models like Komaki XR1 (₹29,999).

- Jaipur saw a 154% YoY spike in E2W sales, aided by Rajasthan’s ₹20,000 subsidy and Ola’s rural outreach.

Why it’s working:

- E-commerce demand – Delivery fleets in cities like Lucknow and other Tier-2 cities are increasingly switching to EVs to cut fuel costs and improve efficiency.

- EV penetration in tier 2 and tier 3 cities has surged, reaching 10.67% and 8.68% respectively in FY2025, driven by affordable models, improved charging infrastructure, and local government efforts to expand accessibility.

Subsidies: Hits and Misses

While incentives drive adoption, their impact varies:

- Direct cash benefits: Maharashtra offers a 10% subsidy on the base price of electric two-wheelers (E2Ws), along with road tax and registration fee waivers and toll-free travel on select expressways, making EVs more accessible—especially in urban areas. However, rural buyers sometimes face challenges accessing these benefits due to documentation and procedural hurdles

- Indirect perks: Karnataka has prioritized charging infrastructure over direct subsidies, now boasting 5,765 public charging stations, with Bengaluru having over 85% of the state’s charging stations.

- Tier-3 hurdles: Gujarat reduced EV road tax to just 1% until March 2026, making EVs more affordable.

Mixed results

Success: Maharashtra’s hybrid approach drove a 9x sales jump since 2021 from about 24,000 units to over 2,12,000 in FY2025.

Stagnation: Uttar Pradesh, despite over 1.02 lakh E2W sales, has an E2W penetration rate of only about 4% of its total two-wheeler market, highlighting that policy support and infrastructure are just as important as population size for driving adoption.