Tata Motors’ journey to the pinnacle of India’s electric four-wheeler (4W) market is a masterclass in strategic foresight, ecosystem development, and precise product-market fit. While competitors waited for the market to mature, Tata effectively built the market itself. This first-mover advantage was so profound that by FY2023, Tata commanded an almost monopolistic ~84% of the passenger EV market. Today, while the market is far more competitive, Tata Motors retains its crown, holding a dominant 40% market share in late 2025. This reign was not accidental; it was the result of a deliberate strategy to dismantle the three primary barriers to EV adoption: prohibitive price, range anxiety, and a non-existent charging infrastructure.

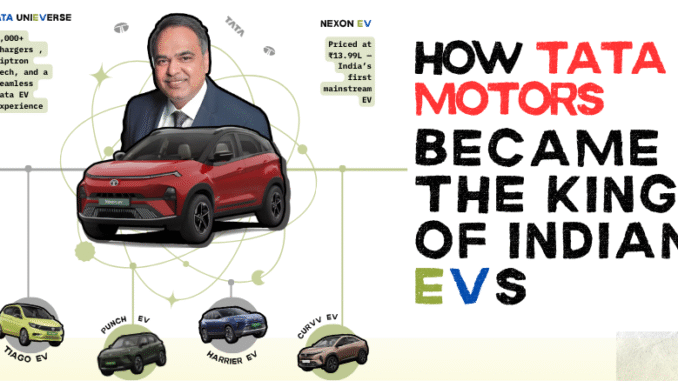

The Catalyst: The Nexon EV Revolution

The entire Indian EV revolution can be traced to a single, pivotal launch: the Tata Nexon EV in January 2020. Before its arrival, EVs were either niche, low-range products or prohibitively expensive imports. The Nexon EV changed the game by hitting a “sweet spot” that competitors had missed. It wasn’t a small hatchback; it was a compact SUV, the most popular and aspirational body style in the country. Launched at an aggressive starting price of ₹13.99 lakh, it was the first EV that felt attainable for the middle class. Paired with a “practical” ARAI-certified range of 312 km and an 8-year warranty, it effectively neutralized consumer fears and became the nation’s best-selling electric car.

Building Confidence: The “Tata uniEVerse”

Tata’s genius was in understanding that selling a car was not enough; they had to sell confidence. The company launched the “Tata uniEVerse,” a holistic strategy that leveraged the power of the entire Tata Group. A critical partnership with Tata Power led to the rapid, visible rollout of a public charging network. Simultaneously, the proprietary Ziptron powertrain technology—a modular, high-voltage EV architecture with IP67-rated battery packs—delivered on performance and safety. Complemented by the practical solution of home charging installation, this ecosystem-first approach revolutionized the consumer perspective on practicality.

Solidifying Dominance: A Multi-Pronged Product Attack

With the Nexon EV as its flagship, Tata executed a brilliant multi-pronged strategy to capture every segment of the market. This assault was defined by a rapid succession of targeted product launches.

| Product | Launch Date | Launch Price (Starting) | Strategic Importance |

| Tata Nexon EV | January 2020 | ₹13.99 Lakh | The “Catalyst.” Created the market and solved range anxiety. |

| Tata Tiago EV | September 2022 | ₹8.49 Lakh | “India’s Most Affordable EV.” Opened the market to the masses. |

| Tata Punch EV | January 2024 | ₹10.99 Lakh | A “Primary Volume Driver.” Electrified a hugely popular model. |

| Tata Curvv EV | Q3 2024 | ₹17.49 Lakh | Expanded the portfolio into the premium design-led segment. |

| Tata Harrier EV | March 2025 | ₹21.49 Lakh | Tata’s “Flagship EV Offering,” competing in the high-end market. |

This strategy created an unstoppable sales trajectory. Tata was the first automaker in India to cross 100,000 EV sales (August 2023) and the first to hit 200,000 (February 2025). Its annual EV sales grew from just 2,244 units in FY21 to 73,833 in FY24.

| Period | Annual EV Sales (Units) |

| FY 2021 | 2,244 |

| FY 2022 | 19,106 |

| FY 2023 | 50,000 |

| FY 2024 | 73,833 |

| FY 2025* | 53,920 |

| *Reflects a partial fiscal year and increased competition. |

New Challenges in a Competitive Market

Tata’s era of near-monopoly is over. While still the leader, its market share has contracted from its peak as rivals have launched aggressive counter-attacks. JSW MG Motor has captured significant market share (climbing to 35% by mid-2025), directly challenging Tata’s dominance. This intensified competition reflects a new, far more challenging market that Tata itself helped create.

From a bold experiment with the Nexon EV, Tata Motors built an EV empire. By getting the product right, solving the core problems of the consumer, and strategically scaling its portfolio, it didn’t just join the EV race—it became the benchmark, earning its crown as the undisputed king of India’s EV 4-wheeler market.