February 4th, 2025

India’s Electric Three-Wheeler Market Sees Record Sales as New Players Challenge Giants

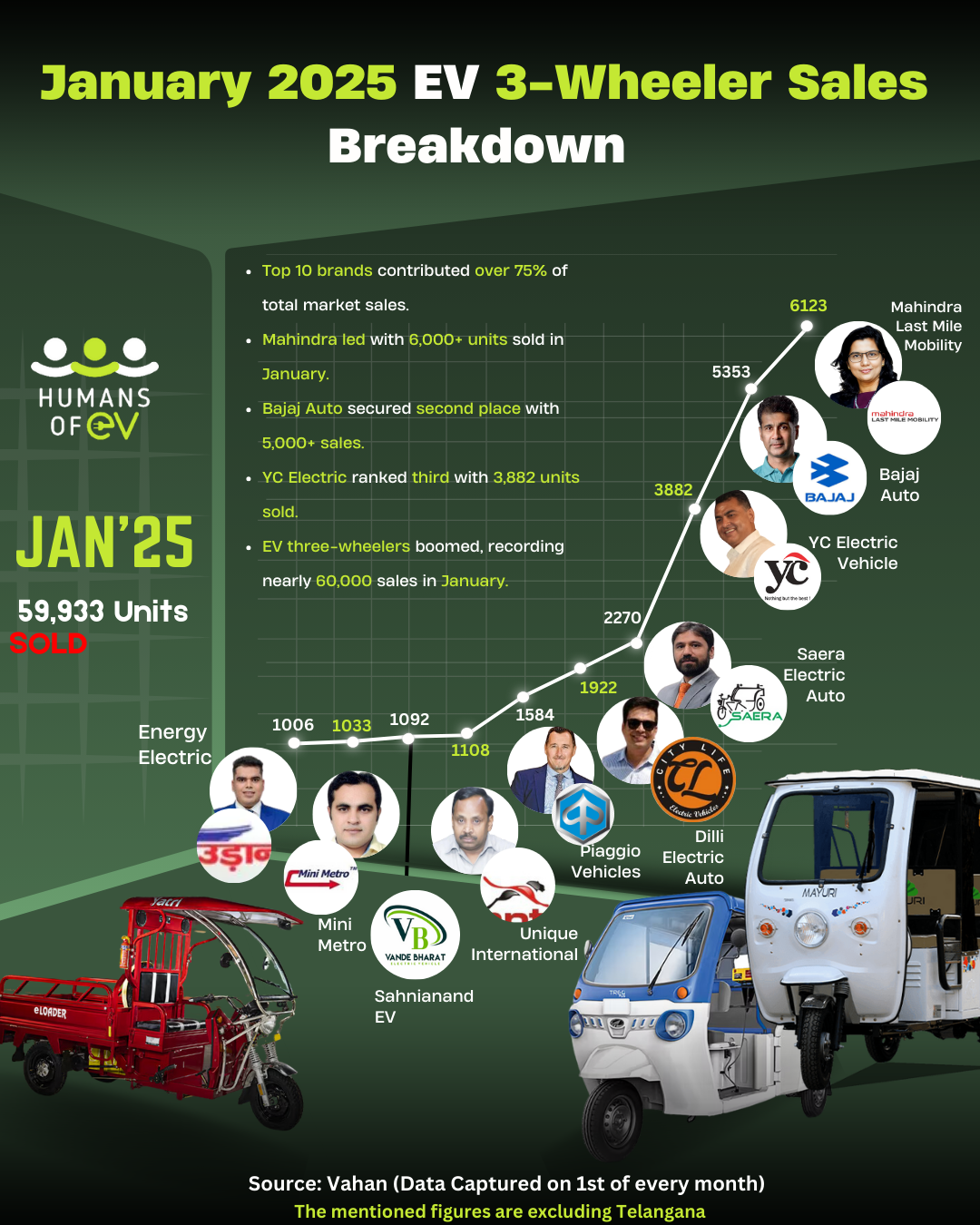

In a significant shift that signals the accelerating transition to electric mobility, India’s electric three-wheeler segment achieved remarkable sales of 59,933 units in January 2025. The market dynamics reveal an intensifying battle between established automotive giants and emerging players, reshaping the landscape of last-mile mobility.

Market Leadership and Competitive Landscape

Mahindra Last Mile Mobility has emerged as the segment leader, delivering 6,123 units and capturing approximately 10.2% of the market share. This performance underscores the company’s successful strategy in the commercial electric vehicle space, particularly in addressing the growing demands of last-mile delivery operations.

“The January numbers reflect a fundamental shift in commercial transport preferences,” notes Amit Kumar, Senior Automotive Analyst at MobilityTech Research. “We’re seeing fleet operators increasingly recognize the total cost of ownership benefits of electric three-wheelers.”

Traditional Giants vs. New Challengers

Bajaj Auto, a stalwart in the conventional three-wheeler market, secured the second position with 5,353 units, demonstrating its successful transition to electric mobility. However, the real surprise came from YC Electric Vehicle, which claimed the third spot with 3,882 units, challenging the traditional hierarchy in the automotive sector.

The competitive landscape shows interesting developments:

Top Performers (January 2025):

- Mahindra Last Mile Mobility: 6,123 units

- Bajaj Auto: 5,353 units

- YC Electric Vehicle: 3,882 units

- Saera Electric Auto Pvt Ltd: 2,270 units

- Dilli Electric Auto Pvt Ltd: 1,922 units

Market Transformation and Innovation

The emergence of new players like YC Electric Vehicle represents a broader trend in the industry. “What we’re witnessing is not just a shift in propulsion technology, but a complete reimagining of the three-wheeler segment,” explains Dr. Priya Sharma, Director of the Electric Mobility Council of India.

Key Market Drivers:

- E-commerce Growth: The booming e-commerce sector has created unprecedented demand for efficient last-mile delivery solutions.

- Operating Economics: Lower running costs and reduced maintenance requirements are driving fleet operators toward electric options.

- Infrastructure Development: Improving charging infrastructure is addressing one of the primary barriers to adoption.

- Policy Support: Government incentives and regulations continue to favor electric vehicle adoption.

Technological Advancements

The market is seeing rapid advancement in battery technology and vehicle design. Manufacturers are focusing on:

- Extended range capabilities

- Fast charging solutions

- Enhanced payload capacity

- Advanced telematics integration

Future Outlook

Industry experts project the electric three-wheeler segment to maintain its growth trajectory throughout 2025. “The January numbers are just the beginning,” states Rajesh Mehta, Head of Electric Vehicle Research at AutoTech Consulting. “We expect monthly sales to cross the 75,000-unit mark by Q4 2025.”

Growth Catalysts:

- Expanding charging infrastructure

- Introduction of battery swapping networks

- New financing models

- Entry of additional players

Market Implications

The evolving landscape presents both opportunities and challenges:

For Established Players:

- Need to accelerate innovation

- Focus on service network expansion

- Development of competitive financing solutions

For New Entrants:

- Opportunity to capture market share through innovation

- Challenge of building brand trust

- Need for robust after-sales service networks

Conclusion

January 2025’s sales data indicates that India’s electric three-wheeler market is at an inflection point. The combination of established players’ experience and new entrants’ innovation is creating a dynamic ecosystem that benefits end-users while accelerating the transition to sustainable mobility solutions.

As the market continues to evolve, success will depend on manufacturers’ ability to balance innovation with reliability, cost-effectiveness with features, and brand legacy with contemporary market demands. The next few quarters will be crucial in determining which players emerge as long-term leaders in this transformative sector.