A Bold Reset for International EV Players

India’s electric vehicle (EV) sector is poised for a global shake-up with the introduction of the Scheme to Promote Manufacturing of Electric Passenger Cars in India (SPMEPCI). The new policy marks a drastic cut in import duties on electric cars—from a staggering 110% to just 15%—specifically aimed at drawing major automakers into the Indian market. By offering this incentive, the government signals a clear intent: India is open for business and seeks to be a global hub for EV manufacturing and innovation.

Strategic Incentives and Strict Benchmarks

To qualify for these reduced duties, automakers must commit a minimum of $500 million (about ₹4,150 crore) of fresh investment in new or existing manufacturing facilities within three years. Eligibility is further tightened by stringent targets: annual turnover requirements of ₹2,500 crore by year two, ₹5,000 crore by year four, and ₹7,500 crore by year five; local value-addition quotas of 25% by the third year and 50% by the fifth. The policy also limits duty reductions to fully-built EVs priced above $35,000 (approximately ₹30 lakh), with each manufacturer allowed to import a maximum of 8,000 units annually—any shortfall in quota can roll over. The cumulative cap for these incentives is set at ₹6,484 crore or the total investment made, whichever is lower.

Driving Investment—Beyond Just Cars

The government’s plan isn’t limited to vehicle assembly. Qualifying investments can include outlays for research and development, advanced machinery, and tooling. Additionally, up to 5% of investment can be used for charging infrastructure, and up to 10% for the acquisition of land and building factory spaces. However, only companies with at least ₹10,000 crore in global automotive revenues and assets of ₹3,000 crore are eligible. These criteria are crafted to attract established global names and encourage true industrial capacity-building in India.

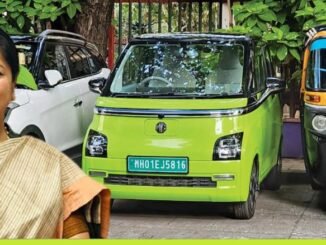

What About Tesla and Other Global EV Brands?

Perhaps the most intriguing subplot is Tesla’s position. The American EV giant has long lobbied for cuts in Indian import duties, but so far has not confirmed plans to manufacture locally. While the new policy may pave the way for Tesla and similar brands to test the Indian market via imports, the key incentives—including the 15% duty—are strictly tied to actual manufacturing investment. Without a commitment to set up domestic production, Tesla and others may benefit from short-term import allowances, but could miss out on the deeper incentives driving India’s EV localization agenda.