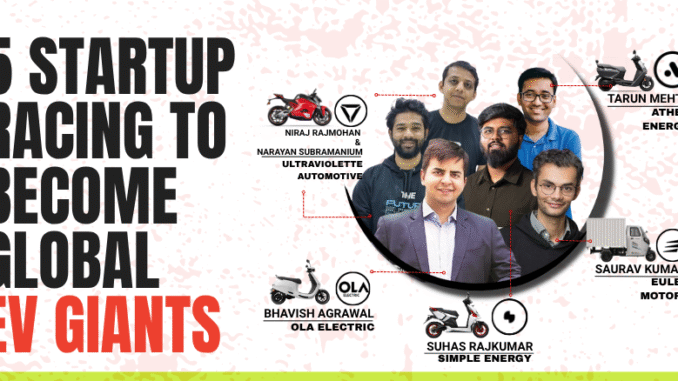

While Silicon Valley’s EV narrative dominates global headlines, five Indian startups are forging a new path to electric mobility leadership. With India’s EV market projected to reach $132 billion by 2030 after attracting $3.7 billion in funding across 119 startups since 2014, these companies represent more than domestic success stories—they’re blueprints for global conquest.

The Indian Crucible: Where Giants Are Made

Despite current EV penetration of just 7.66% compared to the global average of 16.48%, India remains the fastest-growing major EV market globally. The unique dynamics here—59.9% of sales from two- and three-wheelers, extreme price sensitivity, and challenging infrastructure—create evolutionary pressure that produces remarkably resilient companies. These aren’t vehicles designed for California’s highways but solutions engineered for Mumbai’s chaos, making them perfectly suited for the world’s emerging megacities.

Ather Energy: The Tech Purist

With 46% of employees in R&D and $502 million raised, Ather has built an Apple-like ecosystem around its scooters. The company controls 80% of key hardware and 100% of its AtherStack software, deploying 3,611 chargers across 360+ cities. Its breakthrough Heavy Rare Earth Free motor eliminates Chinese supply chain dependencies.

Already operational in Nepal and Sri Lanka with 19 experience centers established, Ather’s methodical “puddle-jumping” strategy targets Southeast Asia, Europe, and the Middle East by 2025. Backed by Hero MotoCorp, Tiger Global, and India’s NIIF, the company prioritizes sustainable expansion over rapid scaling.

Ola Electric: The Manufacturing Colossus

Ola’s audacious vision centers on unprecedented scale. Its 500-acre FutureFactory and adjacent Gigafactory for battery cell production represent one of the world’s largest EV manufacturing complexes. With over $1 billion raised from SoftBank, Tiger Global, and Temasek, plus a ₹5,500 crore IPO in August 2024, Ola commands massive resources.

Despite market share volatility—peaking at 52% in June 2024 before dropping to 17-18% by mid-2025—Ola’s global plans remain expansive, targeting Nepal, Latin America, ASEAN, Europe, and Africa. Success hinges entirely on the Gigafactory delivering promised cost advantages.

Ultraviolette Automotive: The Performance Pioneer

Taking the inverse approach, Ultraviolette launched in Germany first, establishing distribution across Germany, Austria, Switzerland, and Italy by June 2025. Its F77 MACH 2 delivers 323 km range, while the new X-47 Crossover features integrated radar—a world-first for motorcycles.

With $104 million from prestigious investors including Lingotto (Agnelli family/Ferrari), TDK Ventures, and Qualcomm Ventures, Ultraviolette targets 10 European countries initially, aiming for 40 global markets. It’s building India’s first truly premium global motorcycle brand.

Euler Motors: The Commercial Workhorse

Focused exclusively on B2B markets, Euler has raised $206 million with Hero MotoCorp holding 32.5% stake alongside Singapore’s GIC and British International Investment. Its HiLoad EV offers segment-leading 688 kg payload capacity, while its rare-earth-free motors provide crucial supply chain independence.

Serving Flipkart and BigBasket domestically, Euler’s rugged, high-payload vehicles are designed for the logistics challenges of emerging market megacities—from Delhi to Jakarta to São Paulo.

Simple Energy: The IPO-Bound Disruptor

With $51 million raised and a planned $350 million IPO in FY 2027, Simple Energy is positioning itself as India’s first OEM to commercially produce heavy rare-earth-free motors. Founded in 2019, the company offers industry-leading 8-year motor warranties and operates from a 150,000-vehicle annual capacity facility in Hosur, Tamil Nadu.

Currently holding 5% market share with 53 outlets nationwide, Simple Energy plans aggressive expansion to 150 stores and 200 service centers by 2025. Its Simple One delivers 248 km range while the Simple OneS offers 181 km, targeting the value-conscious North Indian market for breakthrough growth toward a top-three market position.

The Verdict: Three Different Races

Fastest to major Western markets: Ultraviolette has already won, launching successfully in Germany.

First to achieve significant international volume: Ola Electric could leverage its manufacturing scale, but B2B players might secure massive fleet contracts first.

Most sustainable global business: Ather Energy’s methodical, profitable expansion approach appears most resilient long-term.

These five companies represent more than startup success stories—they’re proof that India’s EV ecosystem has matured from market to manufacturer, ready to electrify not just India’s streets, but the world’s cities.